Year-End Letter and Checklist for Individuals

Dear My CPA Guy client:

It is tough to believe another year has come to an end, and another tax filing season is almost upon us. Tax season is a difficult but fun part of our year as we get to see you and catch up on how things are going in your life.

There are some exciting new and expanded tax credits available for home energy efficiency improvements that could provide substantial tax benefits. If you installed a new furnace, A/C, boiler, heat pump, water heater, wood stove, windows, doors, insulation, solar, or battery storage, please be sure to bring a copy of the invoice/s with you to the tax appointment or send it to us for your file.

Additionally, if you purchased a new or used electric or hybrid car in 2024 there may be a credit for you so please provide us with a copy of the invoice.

Changes to contributions to a Roth in a SIMPLE retirement plan, including company Roth matching, education savings 529 plan changes, and increased retirement contribution limits have been put into place. I believe retirement savings is a major area of tax planning we can help you within 2025.

We are incredibly grateful for you and truly want to thank you for being our client! We have fun working with you, tax planning and beating the IRS the best we can (within all legal means of course!), and keeping in touch about what’s going on in your life.

We sincerely believe our practice of meeting clients in person, the old-school way, will never go out of style and is what makes us different from the other practices who prefer clients drop off their information for someone to input data and do a quick review before finishing your return. We want to stay in touch with you and be here for you all year so any time a change happens in your life or you are rolling an idea around in your head, you can ask us about the implications for taxes and more.

We have a year-end business client letter and checklist on our resource page as well if it is needed.

Our mission is to provide total peace of mind as the friendliest and most trustworthy CPA firm. Please give us a call or send us an email with any questions so we can help you.

THANK YOU again from everyone here at My CPA Guy. We wish you an incredible 2025 full of the Lord’s blessings and favor in your life.

Sincerely,

Nathan Ziegler & the Team

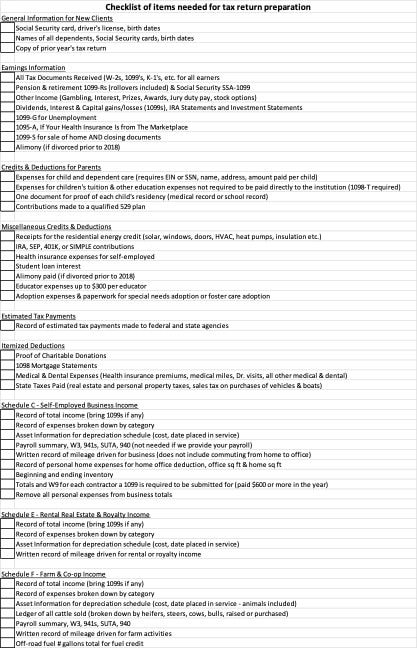

Click here to download the Checklist – What to Bring for Tax Return